As the fifth largest economy in the world,1 Southeast Asia is an understandably attractive market for many exporters. And while trade in this part of the world has inevitably suffered from the effects of the pandemic, its eCommerce market appears more buoyant than ever. Already worth an estimated USD62 billion in 2020, it’s expected to grow to USD172 billion by 2025.2 In 2020 alone, over a third of all online commerce in the region was generated by new shoppers, with 8 in 10 intending to continue shopping online after the pandemic ends.2

More than a dozen different countries make up Southeast Asia, but it’s Indonesia, Malaysia and Singapore that offer an especially tempting proposition to potential exporters. Indonesia is the region’s largest market—and the low barriers to entry in both Malaysia and Singapore make them relatively easy jump-off points for selling to other countries nearby. There’s also widespread English proficiency in these two countries, and both their infrastructures are well-developed.

In light of that, let’s take a closer look at Singapore in a bit more detail. In this guide, you’ll gain an up-to-date overview not only of its current economic position, but also the impact of the pandemic, new and emerging shopper trends—and, of course, the strategies you can use to reach new customers there.

Market overview

A highly-urbanised and bustling trade centre, Singapore’s 2019 GDP of USD372.063 billion3 makes it Southeast Asia’s fifth largest economy. With a population of 5.7 million3 people and diverse international connections, it’s an attractive and accessible country for many businesses to expand to, especially via cross-border eCommerce.

eCommerce in Singapore

Internet penetration in the country is currently 88%, and 95% of users also go online via their smartphones.4 Its high level of urbanisation and small size (around 300 times smaller than London) means Singapore has nationwide eCommerce delivery coverage, too. While the value of its eCommerce market stood at USD2.32 billion in 2019,4 this will no doubt have grown substantially with consumers having to shop online rather than visit physical stores during 2020’s lockdown and the subsequent travel restrictions.

The top 10 leading eCommerce players in Singapore are:5

Shopee

Lazada

Qoo10

Amazon

EZBuy

Courts

eBay

Zalora

Love, Bonito

Forty Two

Impact of COVID-19 on the market

Like many countries, Singapore imposed a lockdown period from April 2020 to end of May 2020 to help contain the virus. Despite the inevitable damaging impact to businesses and global trade, a survey6 conducted soon after revealed that 71% of Singaporeans expect their economy to recover by 2021 or before, and over a third (36%) feel hopeful that things will improve. And their cheery outlook is by no means unfounded. In October 2020, The Straits Times7 reported Singapore’s economy in Q3’20 saw signs of recovery, thanks to its phased reopening efforts after lockdown ended. Likewise, Business Times8 observed that while retail sales had dropped since the outbreak, the actual rate of decline slowed towards the end of 2020—clocking an 8.6% decline in October, versus 10.7% in September.

All that being said, nearly 2 in 3 Singaporeans (64%) still harbour concerns about job security, and almost half (47%) want to switch to lower-priced brands where possible.

Adapting to working from home

With lockdown in place and many people working from home, iPrice5 noted that Singaporeans had a 51% larger average online basket size in the first 6 months of 2020, compared to the same period the year before. In fact, during April 2020, online consumer spend reached SGD358.4 million—outperforming both November and December 2019’s online shopping peaks of SGD288 million and SGD285.6 million respectively.

It’s too early to say just yet whether footfall to physical stores will return to pre-pandemic levels. However, one survey revealed that 59% of people want to keep on working from home even after the pandemic situation improves.9

What are Singaporeans buying online?

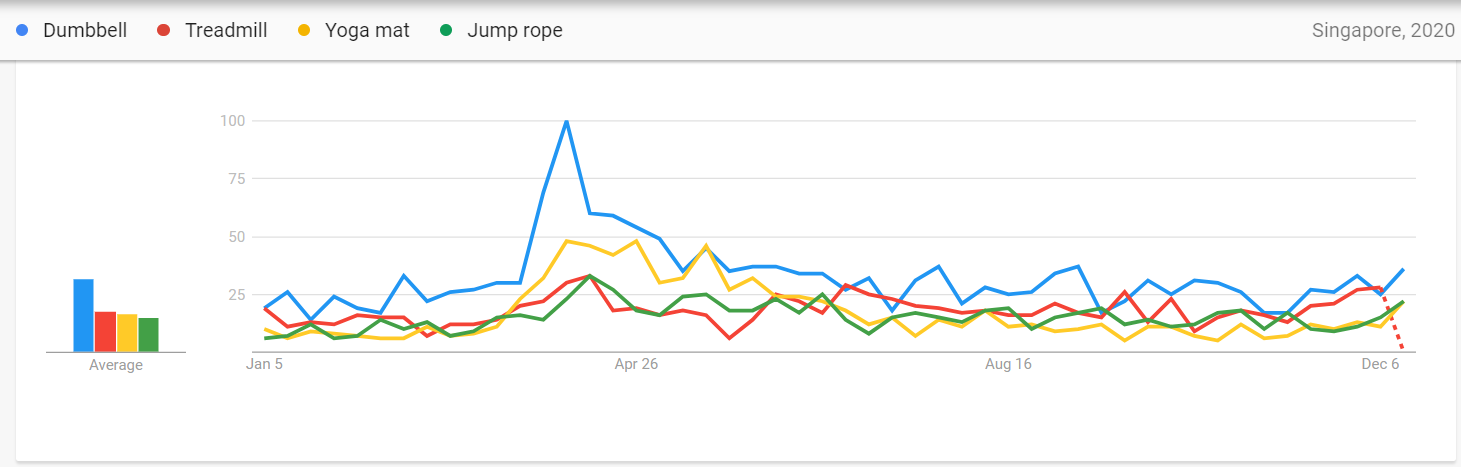

When the lockdown first started, sales of work-from-home gadgets, ergonomic chairs, portable storage devices, headphones, and computer monitors10 all spiked. Interest in new hobbies and exercise equipment11 also increased,12 as did cookware13 products such as hand mixers and electric ovens. However, it’s worth bearing in mind that the phased reopening could make these trends short-lived.

Cosmetics and skincare products

With the population in lockdown and unable to socialise, it was perhaps surprising to see purchases within the cosmetics and skincare categories increase during 2020. According to Skin Inc, this spike was most likely due to people recognising the need for self-care and good mental health during anxious times.14 And with social distancing measures expected to last into 2021, these purchasing trends may yet endure a while longer.

With the population in lockdown and unable to socialise, it was perhaps surprising to see purchases within the cosmetics and skincare categories increase during 2020. According to Skin Inc, this spike was most likely due to people recognising the need for self-care and good mental health during anxious times.14 And with social distancing measures expected to last into 2021, these purchasing trends may yet endure a while longer.

Health supplements

A number of health websites, such as iherb, noticed a sharp rise in sales and interest of vitamin C and other products claiming to boost people’s immune systems. Other bestsellers included probiotics and elderberry supplements.15 While the phased reopening of the economy in Q420 and Singapore’s relatively low COVID-19 case numbers are cause for optimism, it seems consumers aren’t taking any chances just yet: overall, online searches for vitamin C remained consistently higher in 2020 compared to the previous year.16

A number of health websites, such as iherb, noticed a sharp rise in sales and interest of vitamin C and other products claiming to boost people’s immune systems. Other bestsellers included probiotics and elderberry supplements.15 While the phased reopening of the economy in Q420 and Singapore’s relatively low COVID-19 case numbers are cause for optimism, it seems consumers aren’t taking any chances just yet: overall, online searches for vitamin C remained consistently higher in 2020 compared to the previous year.16

Shipping your products to Singapore

Singapore has one of the highest de minimis rates in Southeast Asia, at just SGD 400. As a result, Singaporean cross-border shoppers are able to benefit from a fairly large range of duty-free imports.17

Getting your products into Singapore

Singapore’s main international airport is Changi Airport (SIN), while its primary port is the port of Singapore (SGSIN). The combination of Singapore’s modern infrastructure and small size means last mile deliveries can easily be completed directly from the port, airport or local warehouse, even within a day. As with nearby Malaysia, direct-to-consumer cross-border logistics can potentially offer you a fast time-to-market. This is because imports entering Singapore for personal consumption don’t require registration of your product or business with local authorities—unlike with standard B2B imports.

Despite recent travel restrictions, Singapore’s Changi Airport18 is still seeing a steady flow of passenger flights each month—so using air freight to ship your eCommerce goods directly into the country is still a viable option.

If you’re willing to make the investment, working with a local distribution centre will give you the advantage of being able to offer customers speedier—and even same day—delivery. However, doing so will mean you’ll need to register as a local business entity, or work with a local clearing agent to act as an importer of record before you can begin in-country distribution.

Summary

The restrictions brought about by the pandemic have caused major disruption to Singaporean shopping habits. Unable to buy from local suppliers or jump across the border to get their shopping fix, consumers have instead turned to the internet—and are happily choosing global suppliers able to meet their needs. For potential exporters, the future appears to be bright. On the whole, the population feels the economy will soon bounce back, although there is some underlying concern around job prospects and disposable income. As such, many consumers are experimenting with lower priced brands, and this presents significant opportunities for new exporters ready to meet demand with competitive pricing strategies.

Direct-to-consumer cross-border shipping can be a highly cost-effective strategy, and a way to dip your toe in the water and test levels of interest and demand. However, setting up a regional distribution centre may be more preferable if you need a solution covering multiple countries throughout the whole Southeast Asia region. With consistent air freight flight schedules between multiple countries, Singapore could certainly be an ideal location for this.

This guide will hopefully serve as a useful starting point for developing your Southeast Asia export strategy, especially as the region recovers from the pandemic and new opportunities open up. Why not take a look at our other 2021 outlook guides to Southeast Asia, including Indonesia and Malaysia.

This article was originally posted on Janio Asia's blog.

Janio is a cross-border logistics service provider that simplifies eCommerce deliveries in Southeast Asia. Combining technology with market knowledge, Janio provides an effective end-to-end logistics solution, including international cash-on-delivery and customs clearance, where shippers can manage international shipments on a single platform. For more information, please visit https://www.janio.asia

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by