2022 is a challenging year for the Chinese cosmetic market. According to the National Bureau of Statistics, in 2022, the total retail sales of consumer goods decreased by 0.2% year-on-year (YoY), among which the retail sales of cosmetics decreased by 4.5%. Along with the sluggish economic growth and a complete overhaul of regulations, the underlying development logic has changed in China's cosmetic market. In this context, some sectors and brands faded away, while some maintained strong momentum against the headwind and indicated the possible development directions. What can we expect in 2023? By closely observing the Chinese beauty industry, ChemLinked concludes the top 8 possible trends in 2023.

1. High-end remains one of the trends

According to Euromonitor, the market size of China's cosmetics industry was 587.9 billion yuan in 2021, of which the high-end beauty market accounted for 37.8%. It is estimated that the figure will rise to 48%, with the total market size reaching 907.6 billion yuan in 2025.1

Despite the slowdown in economic growth, Chinese consumers are inclined toward high-end cosmetic products due to the upgraded consumption concept. They become more rational in consumption, pursue safe ingredients with high quality and efficacy, and are willing to pay more for better beauty experience. In this context, high-end cosmetic brands win consumers' trust with exclusively developed ingredients, formulas, and the efficacy of products, as well as their well-recognized brand images. In recent years, international beauty groups have constantly introduced high-end brands to China. For example, L'Oréal group has brought at least eight high-end brands to China's cosmetic market since 2020, covering skincare, makeup and perfume categories. Financial results of international beauty giants reveal that consumers' strong consumption of high-end cosmetic products has become a driving force of beauty giants' growth.

Although international beauty giants dominate China's high-end cosmetic market, local beauty enterprises have gradually emerged over the past two years. For example, Yatseng, the parent company of Perfect Diary, has strategically shifted its focus from the mid-to-low-end makeup business to the high-end skincare business. After acquiring high-end skincare brands DR. WU, Galénic, and Eve Lom in 2020 and 2021, the revenue of its skincare category in Q3 2022 increased by 33.0% YoY to 269.4 million yuan and accounted for 31.4% of Yatseng's total revenue, while the makeup sector continued a declining trajectory.

Apparently, both international and Chinese beauty players have been snatching the share of China's high-end cosmetic market. The strong growth accompanied by intense competition is foreseeable.

2. Research and development (R&D) have become more important than ever

With the popularity of functional skincare and the implementation of new cosmetic regulations, China's cosmetic market has gradually upgraded to quality-driven. This is why beauty enterprises have attached more importance to improving R&D competitiveness.

Following P&G's first R&D center in 1998, many international beauty giants, such as L'Oréal, Shiseido, Estée Lauder, Unilever, Kao, and Beiersdorf, set up R&D centers in China to better exploit the Chinese market and meet local demands. In December 2022, Estée Lauder unveiled its new China Innovation Lab in Shanghai to further accelerate growth in the local beauty market. Equipped with collaborative workspaces, interactive testing facilities, packaging model labs, and consumer experience center, this innovation lab reinforced Estée Lauder's strong commitment to local consumers by developing products tailored to the specific features of Asian skin, especially Chinese skin.

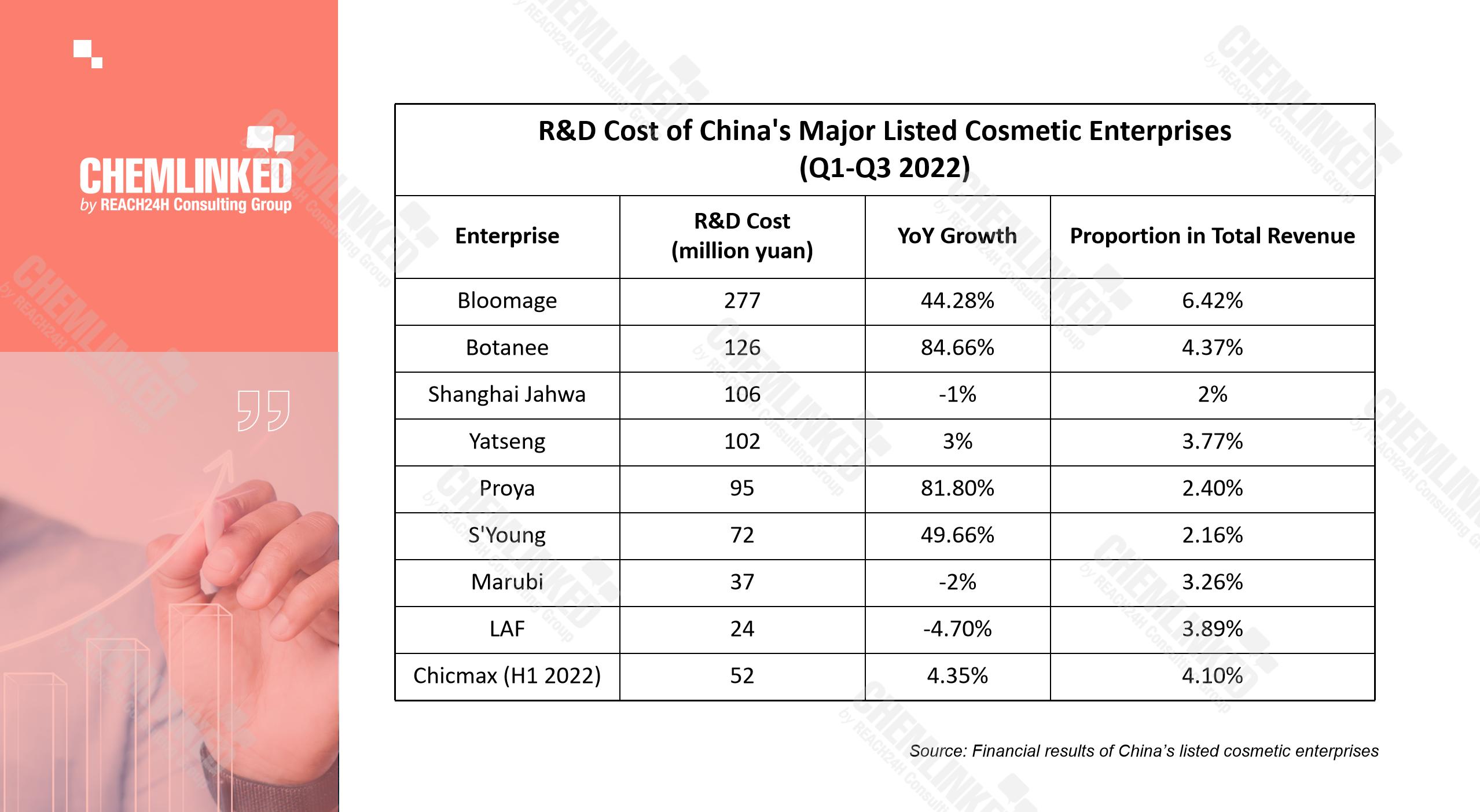

Leading Chinese beauty enterprises such as Shanghai Jahwa, Botanee, Bloomage, Proya, and Chicmax have also seen considerable growth in R&D investment. According to the financial reports of major listed Chinese beauty companies, the proportion of R&D investment has increased constantly, some exceeding that of international beauty giants. In the first three quarters of 2022, Bloomage's R&D investment accounted for 6.42% of its total revenue, and Botanee and Proya's R&D investment increased by over 80%.2 In addition, many beauty enterprises, such as Proya, S’Young, Uniasia, set up the "Chief Scientific Officer" position to strengthen their scientific research capabilities.

Faced with increasingly fierce competition in the functional skincare sector, the importance of R&D has become the consensus in China's beauty industry.

3. Synthetic biotechnology is the next big thing in the thriving functional skincare sector

According to Euromonitor, the market size of China's functional skincare market was about 25.06 billion yuan in 2021, accounting for 22.9% of the entire Chinese skincare market. It is estimated that the market size will exceed 100 billion by 2024. In this context, as the engine for developing raw materials of functional skincare products, synthetic biotechnology has come under the spotlight.

From upstream raw material manufacturers to downstream beauty giants, enterprises such as Shiseido, L'Oréal, Bloomage, and Giant Biogene have entered the synthetic biology sector. In particular, recombinant collagen, an effective synthetic biological ingredient for anti-ageing and skin repairing, is expected to have explosive growth. Currently, Chinese enterprises, including Bloomage, Giant Biogene, Trautec, Jinbo, Jland Biotech, etc., take the leading role in the research and application of recombinant collagen worldwide. It is noteworthy that Shiseido invested in Trautec in August 2022. Afterwards, Trautec independently developed XVII recombinant collagen, which successfully obtained the International Nomenclature of Cosmetic Ingredients (INCI) name in January 2023. Moreover, favorable policies promote the development of recombinant collagen. In 2022, the Chinese Academy of International Trade and Economic Cooperation released the White Paper on the High-Quality Development of China's Collagen Industry, which analyzed the challenges and prospects for China's collagen industry. The White Paper calls on the authority, enterprises, and consumers to pay attention to the high-quality development of China's collagen industry.

For the Chinese cosmetics market, synthetic biotechnology will bring far-reaching impacts. With the gradually extensive application of synthetic biotechnology in China's beauty industry, the industrialization of new materials has become feasible. Meanwhile, as synthetic biotechnology reduces the use of fossil resources, the pollution generated during raw material production can be alleviated, which conduces to the sustainable development of beauty enterprises.

4. The booming Chinese perfume market

According to Euromonitor, the retail sales of China's perfume market in 2021 was 14.09 billion yuan, a YoY increase of 38.7%. The compound annual growth rate (CAGR) from 2016 to 2021 was 21.4%, about ten times that of the world market. The estimated sales of the Chinese market would reach 37.13 billion yuan in 2026, with a CAGR of 22.3% from 2022 to 2026.3 However, the market penetration rate of perfume is only 5% in China which is far below western countries, indicating sufficien market potential.

In recent years, international beauty groups have accelerated the introduction of high-end perfume brands into the Chinese market. Brands including Maison Margiela, Penhaligon, Editions de Parfums Frédéric Malle, BY KILIAN, L'Artisan Parfumeur, Serge Lutens, MUGLER, Viktor & Rolf, and Maison Francis Kurkdjian entered China successively. Notably, most of the perfume brands introduced in recent years are niche brands. It indicates that international beauty groups' aim to further penetrate China's perfume market with high-end niche perfume brands turns out to be fruitful. Data show that the sales of niche perfume rose significantly in 2021. Sales of niche brands, including Maison Margiela, By Kilian, Editions de Parfums Frédéric Malle, and Creed grew by over 100% YoY, among which Maison Margiela surged by more than 800%.3

Meanwhile, emerging Chinese brands have sprung up to seize the perfume market share. From January 2020 to July 2022, the sales of Chinese perfume brands represented by Beast, Boitown, To Summer, and Documents were 2.58 billion yuan on Ali platforms, accounting for 22% of the entire perfume category.

Based on perfume consumption in the Chinese market, several trends can be concluded:

Perfumes have further penetrated daily life, with diversified demands in different scenarios.

Niche perfumes are sought after by consumers to demonstrate individuality.

Consumers seek emotional value through wearing perfumes, such as relaxation, comfort, and confidence.

Factors related to health, nature, and cleanliness are highly concerned.

Consumers increasingly gain perfume information and buy products through omnichannel approaches.

Perfume has become a popular choice for gift-giving.

Household fragrance has witnessed remarkable growth.

5. Great potential to explore in China's male cosmetic market

As Chinese male consumers improve their skincare awareness, the demand for male skincare products has been growing constantly, which leads to an enlarged market size. According to iiMedia, China's male skincare market size was 9.9 billion yuan in 2021, with a YoY increase of 23.8%. This figure is expected to exceed 10 billion yuan in 2022 and reach 16.5 billion yuan in 2023.4 During the "6·18" Shopping Festival in 2022, the overall sales of male skincare products on Tmall surged by 20 times.

China's male skincare market has gradually shown a segmentation trend. In 2020 and 2021, the market focused on basic facial skincare products such as facial cleansers and toners, supported by the high penetration of these categories on e-commerce platforms. In 2022, the growth of segmented and high-end male skincare sector accelerated. Data shows in 2022, topics about male anti-acne & oil control cleansers, sunscreen, perfumes and hand lotion increased by 732%, 96%, 320% and 1,645%, respectively. Meanwhile, from January to November 2022, sales of male facial essence priced below 100 yuan on Tmall fell by 47% YoY, while the figure rose by 105% and 177% respectively, for male facial essence priced at 100-164 yuan and 164-402 yuan.5

In terms of the competition landscape, international giants attach greater importance to the high-end male skincare sector in 2022. For example, Shiseido launched a high-end skincare brand SIDEKICK for Asian Gen Z male, as one of its most critical efforts in the Chinese market. In December 2022, Kao announced its Gen-Z targeted makeup brand UNLICS and considered China the main battlefield in Asia beyond Japan. Estée Lauder also announced that it would establish a male skincare research center in the newly unveiled China Innovation Lab to develop male skincare products based on the needs of Chinese male consumers.

Compared with the entire Chinese cosmetics market, the male cosmetic market still in the early stages with huge space for growth. By developing high-quality products under potential categories and leveraging marketing campaigns to attract traffic, male cosmetic brands are seizing the opportunity for growth in the fast-developing Chinese male cosmetic market.

6. Technology-driven beauty customization ushers in a broad prospect

From product manufacturing to retail service, technological innovation has brought changes throughout the beauty industry. In particular, the technology-driven beauty customization has become focus of beauty giants, as consumers especially the young generation increasingly emphasize uniqueness and individuality. Also, customized cosmetics are more targeted to solve different skin problems.

At the China International Import Expo of 2022, international beauty giants brought high-tech tools for personalized beauty services. L'Oréal presented the YSL Scent-Sation, an in-store experience device based on electroencephalo graph, which leverages neuroscience to provide personalized fragrance advice. As this immersive experience device connects scents to emotion, it can decode what consumers prefer to smell and thus help to find the perfect fragrance. Besides, Shiseido exhibited the brand IPSA's personalized customization projects. By providing professional skin tests through the testing tool "IPSALYZER" and visualizing skin problems, IPSA helps consumers select the most suitable lotion. This project is expected to be launched in Shanghai in 2023.

Regulations also support the development of beauty customization. In August 2022, Several Provisions on Innovative Development of Cosmetics Industry in Shanghai Pudong New Area came into effect, encouraging innovative cosmetic development to meet consumers' individual needs. In November 2022, China National Medical Product Administration (NMPA) issued an Announcement on Carrying out the Pilot Project of Cosmetics Personalized Services in Beijing, Shanghai, Zhejiang, Shandong and Guangdong. The pilot project aims to explore feasible models and effective regulatory measures for the high-quality development of beauty customization in China.

With the continuous upgrading of beauty technology and the implementation of supporting regulations, China's cosmetic market will witness an upcoming era of beauty customization.

7. Beauty giants set foot in the arena of venture capital investment

In 2022, L'Oréal set up the Shanghai Meicifang Investment Co., Ltd, conducting its first minority equity investment in the Chinese high-end perfume brand Documents. According to L'Oréal, Meicifang will focus on emerging Chinese beauty brands and innovative projects related to advanced beauty supply chain, digital consumption experience and cutting-edge scientific research. Besides, Shiseido Beauty Innovation Fund is set at one billion yuan, focusing on China's emerging cosmetics, wellness, and related technology enterprises. Chinese beauty enterprises such as Proya, Botanee, Bloomage, Marubi and MAOGEPING also set up investment funds or partnerships, targeting cosmetic raw materials, big health and life science industries.

Those investments mainly focus on two directions: 1) raw materials and biological science; 2) emerging beauty brands. Unlike financial venture capital institutions that only pursue financial returns, beauty giants seek business growth opportunities through their subordinate enterprises as investees. On the one hand, by leveraging shared industrial resources, beauty giants are able to strengthen their raw material R&D capabilities. On the other hand, by optimizing the brand matrix, beauty giants can cover a wider range of consumer needs to clinch new growth.

8. Healthier beauty industry under stringent regulations

After the implementation of Cosmetic Supervision and Administration Regulation (CSAR) in 2021, a series of subsidiary regulations were released in 2022 to consolidate the new cosmetic regulatory framework.

With a complete overhaul of regulations, illegal practices in China's beauty industry have received harsh punishment. In 2022, five enterprises were banned from engaging in cosmetics production and sales, among which two enterprises' responsible persons were banned from cosmetic-related practice for their lifetime. In addition, over 400,000 cosmetic notifications were cancelled based on Administrative Measures on Cosmetics Registration and Notification and its subsidiary regulations.

New regulations also put forward higher requirements for cosmetic registrants and notifiers. For example, Good Manufacturing Practices for Cosmetics clarifies the responsibilities of the entrusting party in entrusted production, including establishing quality management systems, setting up the position of person in charge of quality and safety, and supervising the production activities of the entrusted production enterprises. Measures for the Management of Cosmetic Adverse Reaction Monitoring stipulates the responsibilities and obligations of cosmetic registrants and notifiers in the monitoring of adverse reactions of cosmetics. The whole process supervision under new regulations reveal that cosmetic registrants and notifiers must keep a watchful eye on every step of the product life cycle, from fulfilling pre-market registration and quality control obligations, to post-market adverse reaction monitoring, product risk control, raw material safety reassessment, etc. More regulatory updates in 2022 on ChemLinked.

With more regulations taking into effect in 2023, the entire beauty industry will develop more healthily and orderly.

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by