“Health” and “beauty” are amongst the top most searched keywords across China’s vast e-commerce platforms according to a recent Tmall data report. According to the data and analysis included in this report, from 2018 to 2019, the sales volume of ready-to-eat bird’s nest (a product purported to delay skin aging and improve skin tone) is over 1.4 million and the sales of formulated meal replacements (usually pitched as body recomposition aids) was over 1 billion Yuan.

Secrets of Emerging Niche Brands

Innovative new products targeting health and beauty consumers are hitting the Chinese market in greater numbers than ever before. The New Zealand health product manufacturer MitoQ and its CoQ10 antioxidant and moisturizing capsule are a great example of a niche product that is making waves in China.

Other successful new entrants include Danish brand NOVO VITA’s Pycnogenol product, French manufacturer Biocyte’s skin whitening pills and Hungarian Vitaltrend’s collagen powder. Based on a report published by Mintel, in the past 12 months, 44% of Chinese female consumers aged 25 to 29 have purchased dietary supplements for cosmetic purposes [3].

Beauty devices have also gained major traction amongst Chinese consumers. According to data from e-commerce giant Tmall, the sales volume of beauty devices has increased by 700% in 2019 compared to 2018. A major contributor to this phenomenal growth is the success of RED, China’s first major social e-commerce platform. The platform utilizes UGC (User-Generated Content) which includes reviews, testimonials, recommendations, how-to videos, live streams, etc. and allows real users to share their experience and ultimately sell products. The sales of beauty devices manufactured by Tripollar, Ya-Man, and Nuface were over 1.4 million.

Evidenced-Based Efficacy: Multinationals Prioritizing Scientifically Substantiated Active Ingredients

One major trend shaping both new product development and consumer purchasing preference in the cosmetic sector is the rise of the “skintellectual”, a term used to describe consumers that want to purchase cosmetics formulated using active ingredients with efficacy and safety supported by strong scientific evidence. In line with this trend, we are also seeing greater play given to the concept of preserving the integrity or enhancing the “skin microbiome” (the overall skin microenvironment including the interplay between host genetics and commensal bacterial species and their relative proportions which naturally colonize the skin and other mucosal surfaces under normal physiological conditions). Lancôme has addressed both key trends in its new product “Advanced Genifique Face Serum” which was launched in China on August 2019.

The concept of the skin microbiome also aligns well with trends towards personalization and bespoke cosmetics. Each person’s skin microbiome is unique and thus an optimal approach to the development of skincare would be to make products which foster healthy microbial balance and decreases the risk of imbalances that could lead to pathology e.g. acne vulgaris and growth of Propionibacterium acnes. Kenjijoel, A Chinese cosmetics KOL (Key Opinion Leader) with over 2.6 million followers said, “We have gradually realized that microorganisms are an integral part of the skin’s natural defenses. Products which factor in the skin microbiome are the future.”

Beauty & Health: More than Face

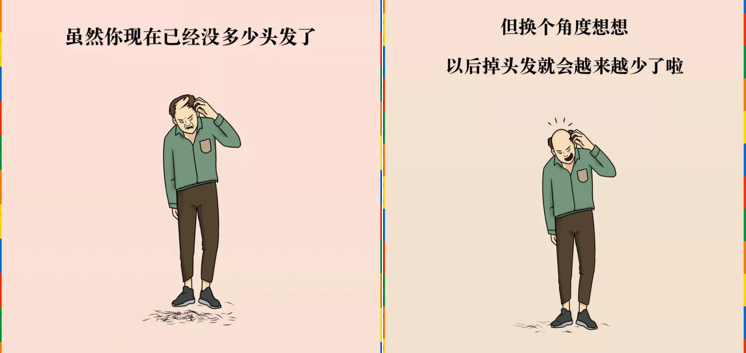

Hair loss and hair damage is another trend shaping product development and purchasing preference in China. Surprisingly younger people are a key driver of this trend. The success of Bawang, a hair growth lotion exemplifies important trends in this sector. The product sold over 43 thousand pieces in a month on Tmall. Moreover, the sales of hair ampoules in 2019 on Tmall increased by 230% from the same period a year earlier.

Other high performing, novel products include fatigue-reducing body oil, eye pressure relieving drops, sugar absorption inhibitors and sleep quality capsules. To some extent, these new trends in China’s health and beauty sector stem from the increasingly stressful life facing modern young Chinese and attempt to offset the negative influences of hectic work schedules, urban pollution, sedentary lifestyles, and poor diets.

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by