A glimpse of state indexes

Over the last several years, China has embraced slower economic growth, which comes after a period of sustained economic development. Today economic growth in China is being driven by private consumption and services. Compared to the West, China's transition to a consumption-driven economic model is not yet complete. Further development and innovation will boost retail sales. One area that we expect to significantly contribute to growth is the integration of online and offline businesses.

Over the last several years, China has embraced slower economic growth, which comes after a period of sustained economic development. Today economic growth in China is being driven by private consumption and services. Compared to the West, China's transition to a consumption-driven economic model is not yet complete. Further development and innovation will boost retail sales. One area that we expect to significantly contribute to growth is the integration of online and offline businesses.

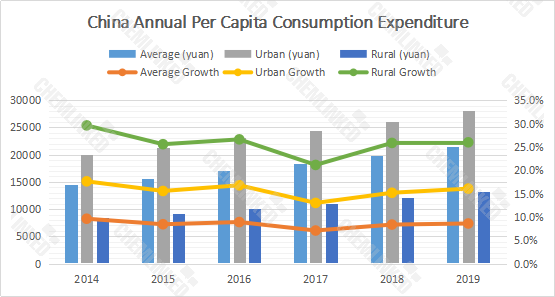

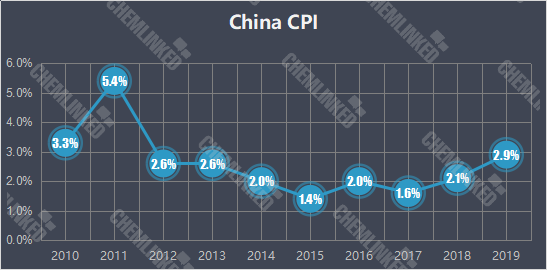

China is facing its most precipitous decline in population in decades precipitated by a decline in the birth rate, but somewhat offset by an increase in life expectancy. These stressors impose considerable pressures on China's economy. The income of Chinese people has grown slowly and has been somewhat eroded by inflationary pressures, as evidenced by increased CPI and higher interest rates on spiraling personal debt. The good thing is consumer confidence has been surprisingly resilient over the past few years, meaning consumers are still willing to spend.

China is facing its most precipitous decline in population in decades precipitated by a decline in the birth rate, but somewhat offset by an increase in life expectancy. These stressors impose considerable pressures on China's economy. The income of Chinese people has grown slowly and has been somewhat eroded by inflationary pressures, as evidenced by increased CPI and higher interest rates on spiraling personal debt. The good thing is consumer confidence has been surprisingly resilient over the past few years, meaning consumers are still willing to spend.

Transformation in the past decade: A chronology of important milestones

2012 - Tmall was originally called Taobao mall. Sales during the inaugural double 11 shopping day in 2012 reached 10 billion yuan, highlighting the vast potential of China's e-commerce sector as a driver of economic growth.

2012 - Tmall was originally called Taobao mall. Sales during the inaugural double 11 shopping day in 2012 reached 10 billion yuan, highlighting the vast potential of China's e-commerce sector as a driver of economic growth.

2014 – There was rapid development of cross-border e-commerce (CBEC) due to the high demand for imported goods like infant formula and healthy food. Later more cross border e-commerce platforms sprang up, including Netease Kaola, which was acquired by Alibaba in Sept 2019, increasing Alibaba's share of China's cross border e-commerce sector to over 50%.

In April 2016, China implemented a new tax policy on CBEC, helping to level the playing field between bricks and mortar retail and CBEC. Currently, 87 cities and the whole of Hainan Province are eligible for the CBEC pilot program. According to cifnews[1], China's cross-border e-commerce transactions reached 9 trillion yuan in 2018, up 11.6 percent year-on-year. Imports accounted for 21.1%, and the transaction volume increased to 26.7% compared to 25% in 2017. There were 232 million CBEC users, according to iiMedia.

2015 was a year for mobile penetration and engagement during which China’s tech giants competed for private domain traffic and developed a large portfolio of apps and services. Additionally, mobile payment penetration, mainly Alipay & Wechatpay, reached 25% from 2011 to 2015[2], reaching 68% in 2018.

2016 – The concept and term New retail was coined by Jack Ma, the founder of Alibaba. His new retail idea is to offer a new shopping experience without boundaries: combining the best of both online and offline commerce. New retail essentially commoditizes the whole supply chain and associated value chain. New retail lives in the intersection between e-commerce, bricks and mortar stores and services (cashless payments, logistics, apps, marketing, and engagement). Additionally, KOL (Key Opinion Leaders) became popular, prompting the rise of social e-commerce and apps like Red, Weibo & Zhihu (Quora in China).

2017 - Ali’s Hema Xiansheng, (a "new retail" business) snowballed. It offers completely cashless bricks and mortar stores, supported by engaging services. Customers can also use their app to order online and have purchases delivered to their house. In addition, Hema emphasizes freshness and also offers in-store experiences allowing consumers to choose their own lobsters, crabs, steaks, etc. and have it cooked in front of them for in-house dining, carry-out, or even delivered to their home or office. Launched in January 2016 in Shanghai, it has now opened over 100 stores across China.

In 2018, Pinduoduo, a four-year-old e-commerce platform, went public on the NASDAQ exchange. Founded in September 2015, Pinduoduo is the fastest-growing e-commerce player in the history of China due to its social e-commerce strategy, which targets price-conscious buyers in low-tier Chinese cities – an underserved market. It enables these buyers to obtain discounts by getting their friends to participate in group buying schemes. The more people that participate in group buying, the larger the discount offered by retailers.

According to the latest data, Pinduoduo has 400+ million monthly active users, making it the second-largest e-commerce app in China by the total number of users, coming just behind Taobao.

2018 was also a huge year for short video apps like Douyin by ByteDance, which became massively popular. The app has 400 million daily active users as of January 2020.

In 2019, China’s first E-commerce law was implemented to better regulate the industry, especially Daigou. Live streaming also rose to prominence and became another important tool to drive consumer engagement and sales.

The implications

1. The Modernization of the Chinese Consumer. Well-educated post 90s Chinese are becoming the major drivers of consumption. These young consumers (the decision-makers of the Chinese family unit) are becoming more selective about where they spend their money. Important considerations are if the product is cost-effective and is supported by engaging services, customer care, and related content, etc.

2. Blitzscaling, digital penetration, and rapid adoption. Big data & technology is transforming China’s markets. The feedback loop between industry and consumers is becoming increasingly sensitive. New China is a world of cashless payments, electronic delivery lockers, smart logistics, new retail, sharing economy, short videos, KOLs, private domain traffic, social e-commerce, and much more. With 5G already widely available in major urban hubs and being rolled out across the country, we can expect the rate of change to increase.

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by