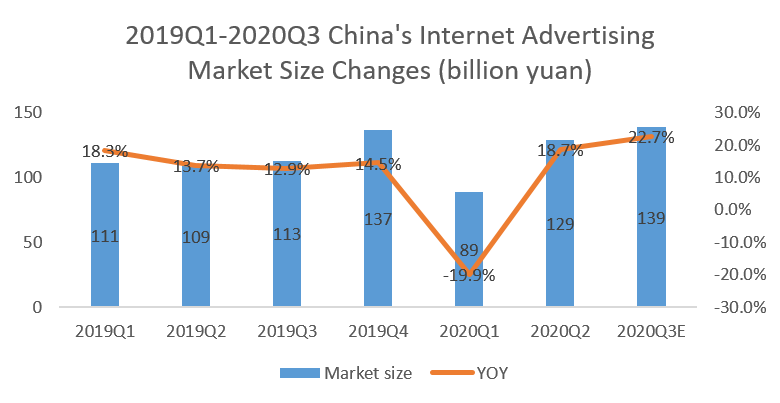

The Chinese internet advertising market size shows an upward trend.

Under the pandemic impact, China’s internet advertising market size in 2020 Q1 decreased by 19.9% year-on-year, but it rebounded rapidly in Q2, rising by 18.7%.

Source: Questmobile

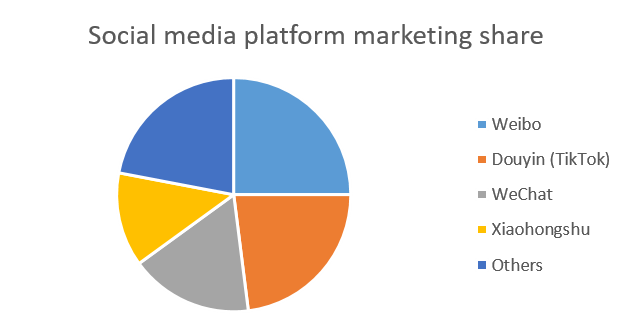

Weibo, WeChat and Douyin (TikTok) are the most popular platforms.

Source: Weiboyi, September 2020

Short video and live-stream have replaced the traditional image-text to become the most preferred marketing forms.

During the 2020 Double 11 Shopping Festival, the advertising budgets of Douyin and Xiaohongshu increased, while the budget of WeChat and other image-text platforms showed a downward trend.

Source: WEIQ

Multi-platform advertising is a popular strategy.

More brands have chosen a combination method for advertising. 66.4% of brands would choose a combination of 2 to 4 platforms, and 18.6% of advertisers would pick 5 to 7 platforms. [1]

For example, brands in the maternal and infant, food and beverages, and beauty cosmetics segments generally do promotion in diverse platforms:

Maternal and infant: Douyin + Weibo + WeChat

Food and beverages: Douyin + Weibo

Beauty cosmetics: Douyin + Xiaohongshu + Weibo

Mid-size KOLs have risen to prominence.

Although the head KOLs can significantly boost brand fame, cooperation with them proves to be low cost-performance due to high threshold and charges. In contrast, the mid-size KOLs (KOLs with less than 100,000 followers) are more selective, cost-effective, and closer to consumers.

Source: WEIQ

Successful live-streaming has appealed to many new players.

In 2020, under the epidemic, offline businesses had suffered setbacks with a large backlog of inventories. Meanwhile, live-streaming has developed rapidly as a low-cost customer acquisition channel.

Statistics show that in the first half of 2020, the total number of live-streaming sessions exceeded 10 million, with an average of nearly 150 live-streams per day. The live-streaming e-commerce market size expected to exceed one trillion yuan in 2020, and the penetration rate of live-streaming e-commerce users among online shopping users has reached 41% by June 2020. [2]

In 2020, the live-streaming anchors’ identities had become more diverse, ranging from CEO’s to celebrities, CCTV hosts, and diplomats.

ChemLinked’s key takeaways for social media marketing in China

Monthly active users: 1.2 billion

WeChat is suitable for end-to-end brand promotion from consumer connection to consumption and repurchase boost, and brand fame diffusion.

Brands should pay attention to private traffic maintenance on WeChat. WeChat provides various private traffic marketing choices such as public accounts, video accounts, mini- programs, WeChat group, and moments.

Mini program and WeChat Moment advertisements are two potential sectors. In 2020 Q1, the mini-program had daily active users of 400 million. [1] The number of daily active users in WeChat Moments had already reached 750 million. They can help reach out more potential consumers and drive conversions for the brands.

Monthly active users: 550 million

Weibo is a public social platform aggregating people of all walks of life: a. Mobile users account for 94%; b. Users below 30 account for 81%; c. Users with high education background account for 78%; and d. Users from third- and fourth-tier cities account for 57%. [1]

Weibo has numerous celebrities and KOLs, with more than 28,000 famous entertainment stars and over 780,000 top influencers.

The marketing focus on Weibo is to use hot topics and celebrity effect to help brands communicate with different consumer groups. For example, brands can use the topic tag and topic page to display brand information as much as possible. They can also endorse famous stars and use their high traffic to boost topic popularity and increase their orders.

Douyin

Monthly active users: 500 million

Douyin has a high content consumption time. In 2020, 38% of users had an average daily usage time of more than 30 minutes, and an average monthly usage time of more than 28.5 hours per person, an increase of 72.7% year-on-year. Using Douyin for marketing will help brands maintain long-term exposure.

Douyin’s sophisticated algorithm system frequently recommends catered contents to each user, meaning that brands can effectively reach and retain consumers who share the same interests.

Brands can use various functions of Douyin, including setting up stores, KOL live-streaming, challenges, and topic discussions to enhance the brand influence among consumers.

Xiaohongshu

Monthly active users: 100 million

Compared with the previous platforms, Xiaohongshu is a platform that has more female and young users and is more life-oriented. Its female users account for 80%, and post-90s users account for 70%. [1] Young people prefer to search for fun and chic lifestyles and learn and share consumption information on this platform. Brands can connect with users and deliver brand concepts through appealing content and frequent interactions.

We recommend beauty cosmetics brands to pool resources on this platform due to its user demographic. In the age of user-generated content, any distinctive or visually attractive product can spur spontaneous content creation and discussion among netizens. Cosmetics quickly bring visual impacts and lead to impulse buying.

We also encourage maternal and child brands to start strategy initiatives on this platform. Since April 2020, the number of notes and interactions relevant to mother and baby has surged on Xiaohaoshu, especially those about mother and baby nutrition and baby complementary food. [3]

ChemLinked is dedicated to helping overseas brands doing localized content marketing in the competitive Chinese market. We can help you attract traffic, increase exposure, and raise consumer awareness on mainstream platforms, including WeChat, Weibo, Xiaohongshu, and Douyin. We can also help you engage in live-streaming e-commerce and KOL endorsement. Contact us at contact@chemlinked.com for more information.

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by