CBD has been a worldwide trend for some time. According to GrandViewResearch, the global cannabidiol (CBD) market was valued at 4.6 billion dollars in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 22.2% from 2019 to 2025. [1] In China, the CBD market size also has reached about 760 million yuan in 2020, and at least 190 companies are involved with CBD while over 50 companies have gained licenses for industrial cannabis cultivation. [2]

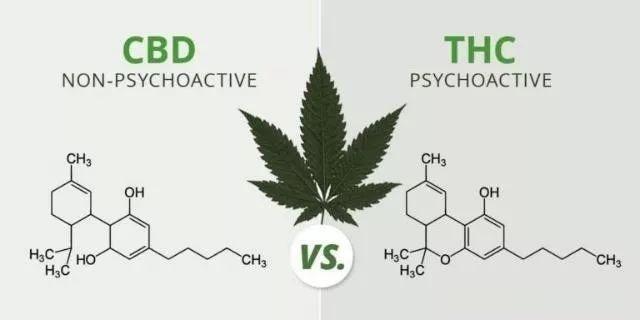

Cannabis contains hundreds of bioactive components. The two components that grab the majority of headlines and the most researched are tetrahydrocannabinol (THC) and cannabidiol (CBD). THC is primarily responsible for the psychoactive effects of Cannabis. A THC content of higher than 0.5% is the cutoff point generally used by different governments to classify the substance as a narcotic. Needless to say, products in the market use raw materials derived from low THC cultivars of Cannabis and take advantage of the CBD components.

However, because China’s government holds a very cautious and even strict attitude to cannabis products, especially considering China has some of the harshest narcotic control laws in the world, cannabis products didn’t have a smooth development over the past few years. Recently, situation has changed recently since many new domestic CBD brands were founded and have achieved good sales, with more international brands following them to enter the market through Cross-border E-commerce (CBEC) platforms.

Domestic brands

In effect, 2020 seems to be the year when domestic CBD brands took off in China.

- Simpcare

Simpcare is undoubtedly the star brand in this CBD market. This brand was founded in August 2019 and is the first domestic brand in China that provides a full line of CBD skincare products. In January 2020, it officially launched its products, and its sales reached 47.16 million yuan in 10 months. In January 2021, its fans on Tmall achieved 450,000. Also, this brand has completed five rounds of financing, acquiring tens of millions of yuan. [3]

- CANNAFEVER

CANNAFEVER is a CBD skincare brand founded in February 2020, and it opened its online store in September 2020. It now has 10 SKUs, and its most popular product is an ampoule collection whose monthly sales exceeded 1000 units. As a new brand, it has completed its Pre-A financing, and its valuation exceeded 100 million yuan. [4]

- INBRIZ CBD

INBRIZ CBD also completed two rounds of financing, securing tens of millions of yuan. As one of the first group of companies that get approval to produce CBD products, INBRIZ CBD now mainly sells its products through offline channels, unlike other CBD brands.

As more players join the market, the competition inevitably becomes more severe which in turn speeds up the social consciousness of "CBD" products. Chinese consumers used to be cautious of CBD products, but now they have begun to realize that CBD is not a narcotic.

International brands

There has also been a significant increase of international brands successfully filing for imported cannabidiol skincare products at the National Medical Product Administration (NMPA) in 2020 with 16 being filed. By comparison, 2019 had zero filings. [5] One important thing worthy of notice is that these 16 products are all from big companies such as LG, and VIVLAS. Because of the risk and cost of the general trade, many niche international CBD brands chose Cross-border E-commerce (CBEC) to enter China’s market.

On Tmall Global, the top CBEC platform in China, consumers can find many imported CBD brands now, such as Uncle Buds, Pacifica, NORDICCOSMETICS, and Revolution. Most of them opened their Tmall Global stores in the last-half of 2020. Their recent monthly sales are in the hundreds.

Page information

In the future

Here are some important points worthy of our attention.

First, brands need to know that current regulations remain a problem for CBD products in China. Only three cannabis-related ingredients, including cannabis Sativa fruit, cannabis Sativa seed oil, and cannabis Sativa leaf extract, are allowed to be used as cosmetic ingredients. Despite the release of new regulations about new cosmetic ingredient registration, CBD’s approval remains a question. It is also one reason why some imported brands chose to enter the Chinese market by CBEC platforms to avoid strict CBD limited regulations in China.

Still, the market has taken off by taking advantage of regulatory gaps. In the future, there is a high possibility that CBD becomes a common cosmetic ingredient, and the regulations will also make progress to accommodate for that growth.

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by

We provide full-scale global cosmetic market entry services (including cosmetic registering & filing, regulatory consultation, customized training, market research, branding strategy). Please contact us to discuss how we can help you by